#349 - From a Progressive Income Tax towards a Degressive: stimulation working hours & motivation! (English)

Hi GuidoFox here! Wonderful that you will read this article!

I was always wondering as a tax student studying at the Erasmus University Rotterdam why we have a progressive income tax system: how more you earn (and/or make more hours), how more you have to pay the tax burden – up to 49,50% by an income higher than 76.817 euro (in the Netherlands).

As we discussed in the colleges, this system is not only fair moral-wise (how more you earn, how more you pay for the society) but also economic-wise ‘efficient’: you cannot escape from your own intelligence and intelligent people (following these models) earn on average more than less educated ones (keep in mind also the extended time/years & studying investments of (long) education with zero income).

Nowadays we cannot only discuss the reliability of these models – because plumbers are the new rich – but more interesting when I studied: where is motivational factor? If you earn between a low and average hourly rate and you prefer to work more hours (a highly motivated person), why you have to come into higher income scales?

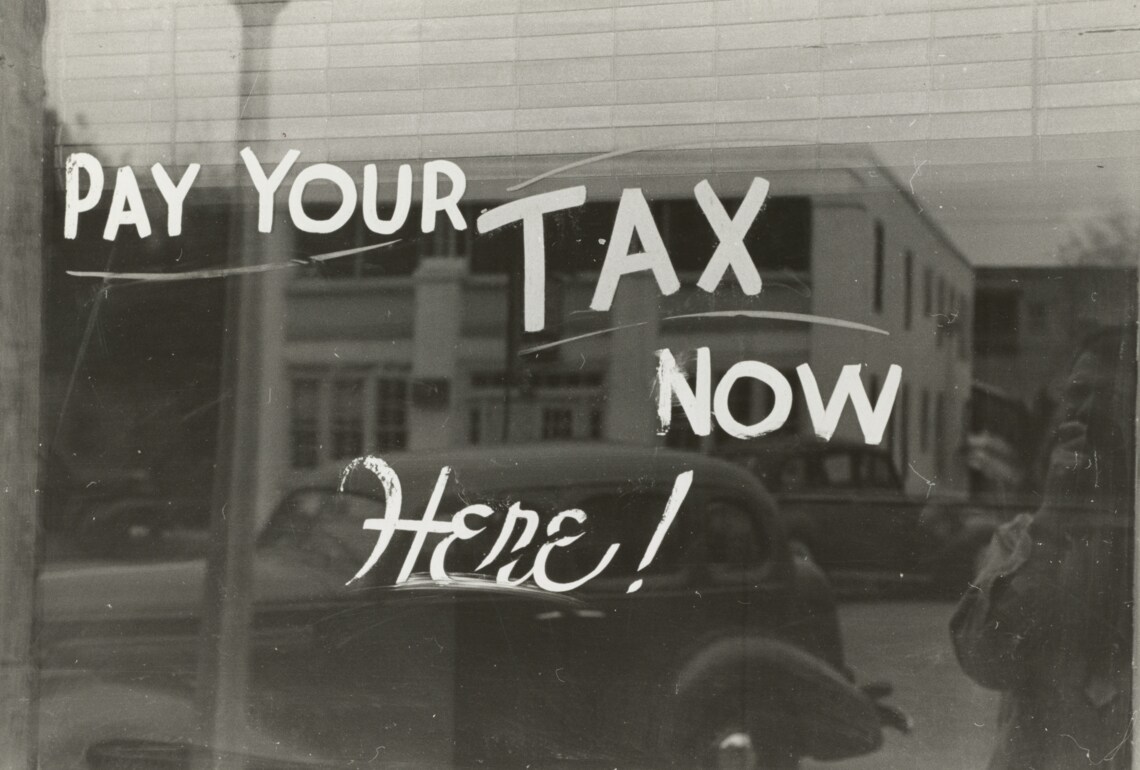

Work must pay

I foresee with the implementation of a degressive tax mechanism whereby you pay less tax (%), when you work more hours/earn more that the government is going to ‘earn more money’, because they ‘sell’ more working hours. At this moment people work too less what they want to do: the taxes become too high by more working hours and loosing different tax surcharges & discounts by a higher income. The opposite of work must pay (werken moet lonen) I think.

I suppose, next to the implementation of a degressive tax mechanism, to make the tax system more simple, fair and efficient. Let’s cut all the tax surcharges & discounts, a.o. the healthcare and rent, to safe juridical (court procedures), administrational and control (bureaucracy) time & costs and lower – with these savings (and other governmental cuts) – drastically the income tax rates.

In companies it’s quite common to receive bonuses when you perform well and work hard: why the (Dutch) tax system is not supporting this mentality at all? With the implementation of a degressive tax system, I think the motivation to work hard (and perform well) will increase and boost the general economy substantial!

Let’s do it!

Greetz,

GuidoFox – Evolve your Life!

High-End Spiritual Life Coach

www.GuidoFox.nl